[ad_1]

Agriculture is a singular enterprise that not solely has excessive manufacturing in addition to value danger, but in addition one the place every part is purchased retail and bought wholesale. This actuality, furthermore, extends even to Goods and Services Tax (GST): Farmers are the one businessmen right this moment who can’t declare enter tax credit score (ITC) on the gross sales they make.

Bhagirath Choudhary, founder-director of the New Delhi-based South Asia Biotechnology Centre, was lately shocked to pay 18% GST on pheromone traps and lures which are utilized by farmers to draw insect pests. “These are required for monitoring and trapping of adult male moths to prevent mating and laying of eggs by the females. We advise spraying of chemical pesticides only as a last resort, when the number of moths caught exceeds a certain threshold level” says the 45-year-old, whose agri-technology dissemination group claims to have reached out to just about 15,000 maize farmers throughout India and distributed 2,500 traps-cum-lures as a part of an academic program to manage the dreaded fall armyworm pest.

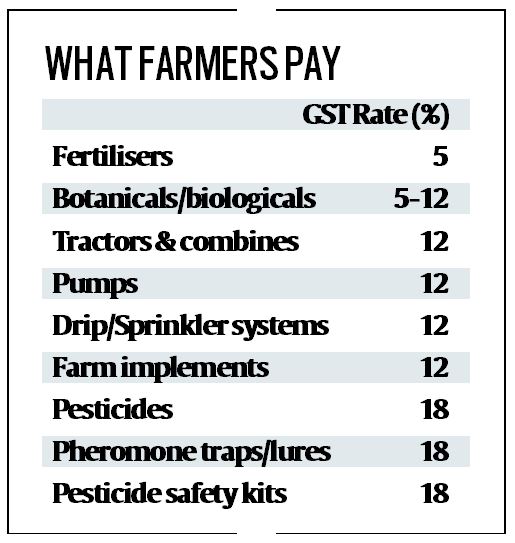

But 18% GST is levied not simply on traps and dispensers impregnated with synthesized mimics of sex-attractants launched by feminine bugs. Even common agro-chemicals/pesticides and security kits (eyewear, masks and gloves) essential to spray these appeal to this responsibility. The GST charges are barely decrease, at 5-12%, for botanical and organic pesticides corresponding to Azadirachtin, Nomuraea rileyi, Metarhizium anisopliae and nuclear polyhedrosis virus formulations, that are additionally used at very early levels of infestation.

“When I first bought 50 traps and an equal number of lures containing pheromones, the bill came to Rs 2,540. Only after checking the invoice did I discover that it included a GST amount of Rs 387.46. That made me curious and find out more. As it turned out, there is GST on every farm input, barring seed and animal/poultry feed. Even on government-subsidised fertilizers, you have to pay 5% GST,” notes Choudhary, who’s himself the son of a farmer from Dudiyon Ki Dhani, a hamlet in Bilara tehsil of Rajasthan’s Jodhpur district.

The drawback, nevertheless, just isn’t with GST per se. The actual problem is that for the GST paid on the acquisition of any enter – whether or not fertilizer, pesticide, pheromone lure, tractor, drip/sprinkler irrigation programs or different agri tools – the farmer has no means to utilizing it for lowering his tax legal responsibility. This is not only as a result of most farmers are ignorant about ITC/GST and can’t afford to rent the providers of chartered accountants. The precise purpose is solely that each one farm produce appeal to zero GST. Hence, there is not any approach a farmer can declare credit score to the extent of GST paid on purchases when he makes a sale.

“It’s one thing for the farmer to pay GST on soap, toothpaste, biscuit, television or two-wheeler, which are all final consumption items. But when he buys fertilizer or pesticide, these are being used for growing crops, not consumption. The farmer’s inability to set off the taxes paid on inputs employed in the production process violates the letter and spirit of GST. In every other business, the goods used as intermediates are eligible for ITC. The same basic foundational principle ought to be extended to farm inputs,” factors out Choudhary.

The proper approach to deal with this anomaly, in keeping with him, is by exempting all farm inputs from GST. Farmers can, in idea, reap the advantages of ITC if their produce can be introduced beneath GST. But doing that may impose pointless procedural burden, just like what lakhs of micro, small and medium enterprises have already skilled publish GST.

“Agro-chemical firms and tractor makers do not thoughts paying GST. In truth, they need this, so as to have the ability to declare credit score for the GST paid on lively ingredient, packaging materials or parts. But why is just the farmer now being pressured to shell out taxes on which there isn’t a set-off facility? The authorities ought to exempt at the least recurrently used farm inputs from GST and system a mechanism for refunding producers on the taxes paid by them, which is able to in any other case be loaded on to the farmer,” he provides.

Choudhary has estimated the GST paid by farmers on crop safety chemical compounds alone — at 18% on a market measurement of Rs 16,628 crore in 2018-19, comprising pesticides (Rs 8,273 crore), fungicides (Rs 4,464 crore) and herbicides (Rs 3,891 crore) ) — at Rs 2,536.5 crore. The most retail value worth of fertilizers bought in 2018-19 was, likewise, roughly Rs 75,000 crore, inclusive of a 5% GST part of Rs 3,750 crore. The annual market measurement of tractors is Rs 42,000 crore, taking gross sales of seven lakh models at a mean MRP of Rs 6 lakh, by which the 12% GST involves Rs 4,500 crore.

“If you add all different inputs — together with electrical/diesel pump-sets, micro-irrigation programs and agri implements (even Happy Seeders touted as an answer to the issue of paddy stubble burning appeal to 12% charge!) — the entire GST being paid by farmers, on which they can not declare ITC, would most likely cross Rs 15,000 crore,” reckons Chaudhary.

That’s fairly a considerable set-off not occurring, about which few farm leaders or politicians claiming to have agrarian background are even conscious.

[ad_2]