[ad_1]

The authorities raised import taxes on goldwhereas rising levies on exports of gasoline and diesel in an try to regulate a fast-widening present

account hole. The strikes despatched Reliance Industries Ltd, and different vitality exporters tumbling, bringing down the benchmark index by as a lot as 1.7%. The rupee fell once more.

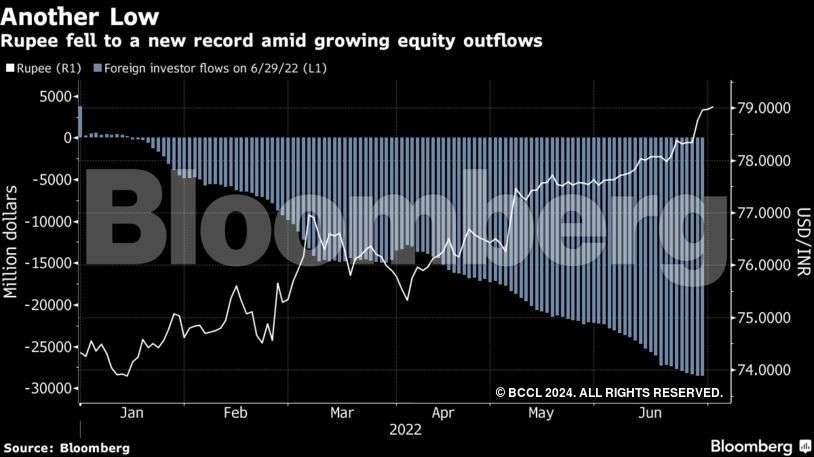

The actions underscore how rising economies, specifically with twin present account and monetary deficits, are more and more dealing with pressures on their currencies as forceful price hikes by the Federal Reserve to intensify outflows. Despite having the world’s fourth-biggest reserve pile, the rupee has hit a succession of report lows in current weeks. The Indonesian rupiah, the opposite high-yielder in Asia, fell to its lowest in two years on Friday.

Policy makers in lots of rising markets face stark selections as they battle hovering inflation and capital flight because the Fed tightens coverage: increase charges and danger hurting growthspend reserves that took years to construct to defend currencies, or just step away and let the market run its course.

New Delhi’s transfer additionally underscores the financial challenges confronted by Prime Minister Narendra Modi’s authorities as inflation on this planet’s sixth-largest economy Accelerates and exterior funds worsen. The central financial institution has been battling to gradual the foreign money’s decline, and runaway rupee depreciation will worsen value pressures, and will spur extra price hikes that weigh on progress.

The measures “aim to reduce the impending pressure on the current account deficit and thus the currency,” stated Madhavi Arora, lead economist at Emkay Global Financial Services. “Complementary policy efforts from both fiscal and monetary side essentially reflects the looming pain on the balance of payments deficit this year.”

While the Reserve Bank of India has been searching for to clean out the rupee’s 6% decline this 12 months, banks have reported greenback shortages as traders and corporations hastened to swap the rupee for different property or to pay for imports. The newest measures had been spurred by a sudden surge of gold imports in May and June, the Finance Ministry stated Friday.

The authorities raised the import responsibility on gold to 12.5%, reversing a minimize final 12 months. The increased taxes on shipments of gasoline and diesel despatched shares of Reliance Industriesa key exporter, down by as a lot as 8.9%.

India is the world’s second-biggest gold client and native futures rose as a lot as 3% in Mumbai, the most important intraday leap in nearly 4 months, because of the increased import prices.

Finance Minister Nirmala Sitharaman stated on Friday that India is searching for to discourage gold imports because it helps protect international trade. She added “extraordinary times” require such measures together with the imposition of a windfall tax on gasoline exports.

“The challenges are emanating from the same source, which is higher commodity prices,” stated Rahul Bajoria, senior economist, Barclays Bank Plc. “India can neither discover provide onshore nor we can reduce the consumption of oil. That makes the entire scenario much more unpredictable each by way of how this performs out and the way lengthy this continues for.”

For the broader fuel market, a drop in Indian exports could further tighten global markets that are grappling with reduced supply from Russia and rising post-pandemic demand.

Friday’s measures highlight the central bank has a tough fight on the external front in coming months. RBI Governor Shaktikanta Das has said the central bank uses a multi-pronged intervention approach to minimize actual outflows of dollars and won’t allow a runaway rupee depreciation.

And while investors have been put on watch over emerging-market stress by Sri Lanka’s struggle with a dollar crunch leading to hyperinflation, the RBI has close to $600 billion of foreign-exchange reserves. But those reserves are depleting as the central bank steps up its fight to stop the slide in the rupee amid capital outflows and a current account gap that is expected to double this year.

“Investors should expect the currency to still depreciate,” said Arvind Chari, chief investment officer at Quant Advisors Pvt. in Mumbai. “Will more taxes on exports impact corporate activity? Maybe not in the short term but it could be in the medium to long term.”

[ad_2]