[ad_1]

India’s financial exercise held regular in February although there have been early indicators of slowing consumption amid issues of future development prospects and hawkish monetary policies,

India’s financial exercise held regular in February although there have been early indicators of slowing consumption amid issues of future development prospects and hawkish monetary policies,

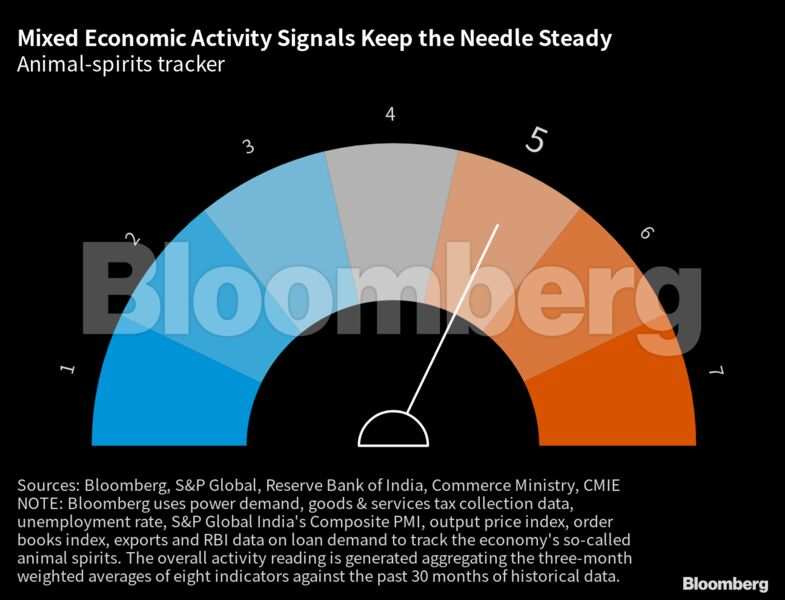

The needle on a dial measuring the so-called animal spirits was unchanged from January when it moved left after selecting up pace for the final month of 2022, signaling weakening home demand is changing into a priority. Eight high-frequency indicators tracked by Bloomberg confirmed moderating credit score development, weak tax revenue and a rising unemployment price.

The central bank is seen to lift charges additional in its subsequent coverage evaluate due April 6 after retail inflation breached the central financial institution’s goal for a second straight month in February. The after-effects of the collapse of Silicon Valley Bank in addition to troubles at Credit Suisse Group AG, and the danger of warmth wave on India’s rural economics may additionally muddy the outlook forward.

Bloomberg’s animal spirits barometer makes use of a three-month weighted common to easy out volatility in single-month readings. Here are extra particulars:

enterprise actions

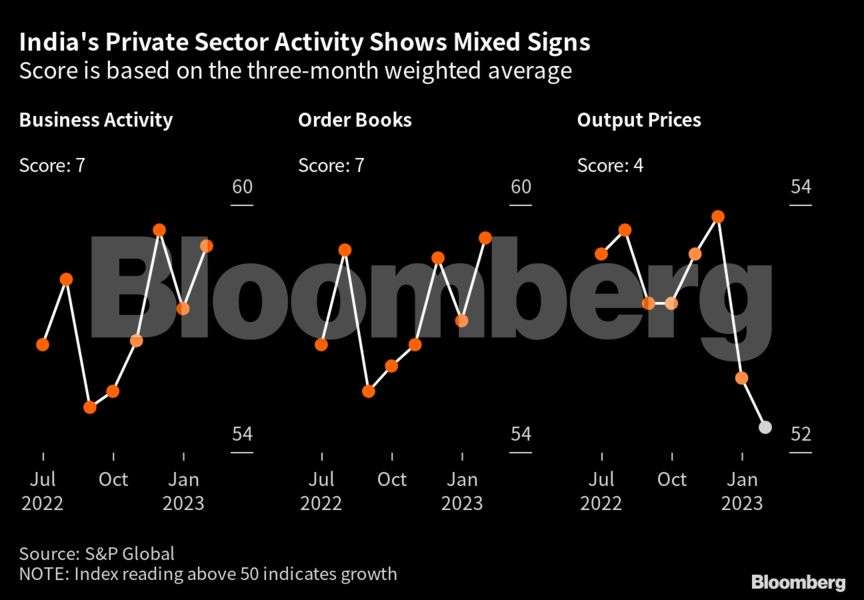

Purchasing managers’ surveys confirmed exercise in India’s dominant companies sector climbed on the quickest tempo in 12 years. Manufacturing exercise expanded at its slowest tempo in 4 months however remained above the 50-mark. That helped take the composite index to 59 from 57.5 in January.

However, jobs development was dampened by a insecurity within the enterprise atmosphere, stated Pollyanna De Lima, Economics Associate Director at S&P Global Market Intelligence. “The degree of optimism recorded in February was the lowest for seven months and below the historical trend as some companies doubted demand would remain this resilient.”

exports

Exports fell 8.82% in February from a 12 months in the past, whereas imports dropped 8.21% — the most important decline in additional than two years.

“Slowing core exports and imports indicate softening global and domestic demand,” stated Madhavi Arora, economist with Emkay Global Financial Services Ltd. However, Arora lowered her present account deficit forecast for the financial year ending March to 2.5% of the gross domestic productfrom 2.6% earlier on sturdy companies exports in the previous couple of months.

client exercise

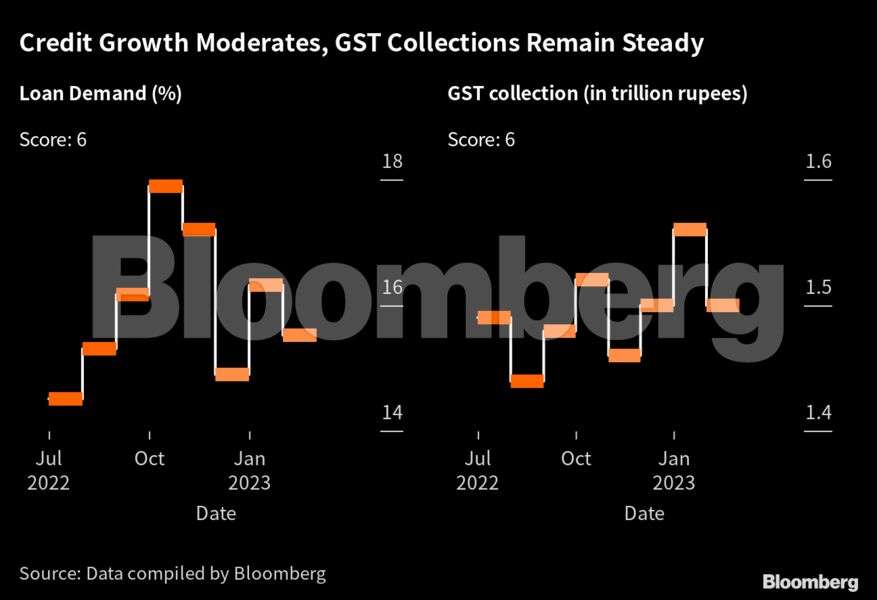

Liquidity within the banking system is tightening, and credit score development moderated to fifteen.52% in February, from 16.33% in January, central financial institution information confirmed.

Goods and companies tax collections, which assist measure consumption within the economicsfell to 1.49 trillion rupees ($18.1 billion) in February from 1.56 trillion rupees in January although it was 12% greater from a 12 months in the past.

New automobile registrations rose 16% within the month, in line with information from the Federation of Automobile Dealers Associations. But passenger automobile gross sales development slowed to 10.9% year-on-year, from a 22% rise seen a month in the past.

market sentiment

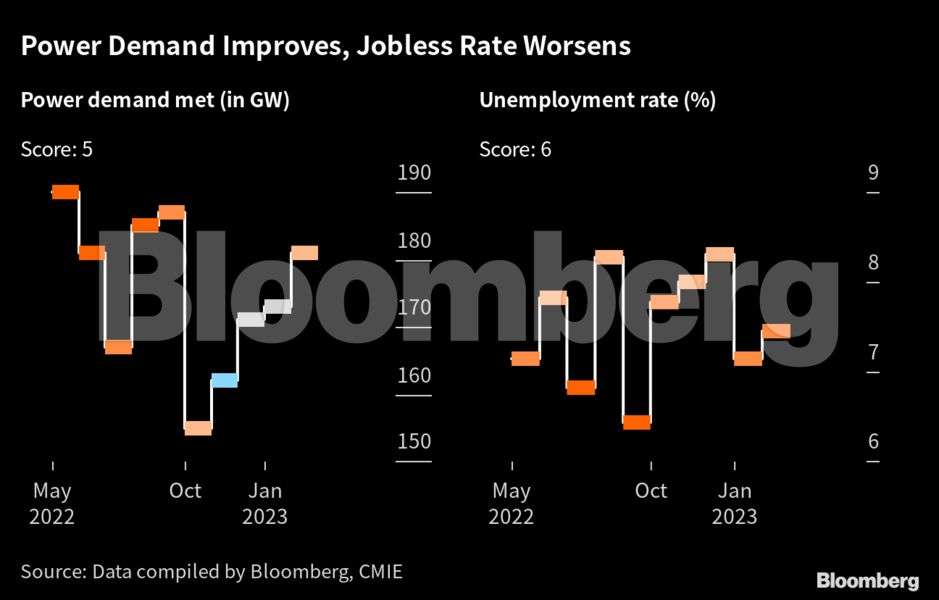

Electricity consumption, a extensively used proxy to measure demand within the industrial and manufacturing sectors, improved. Peak demand in February rose to 181 gigawatts from 173 gigawatts a month in the past amid predictions of hotter climate over the approaching months. India’s unemployment price climbed to 7.45%, from 7.14% a month in the past, in line with information from the Center for Monitoring Indian Economy Pvt.

[ad_2]