[ad_1]

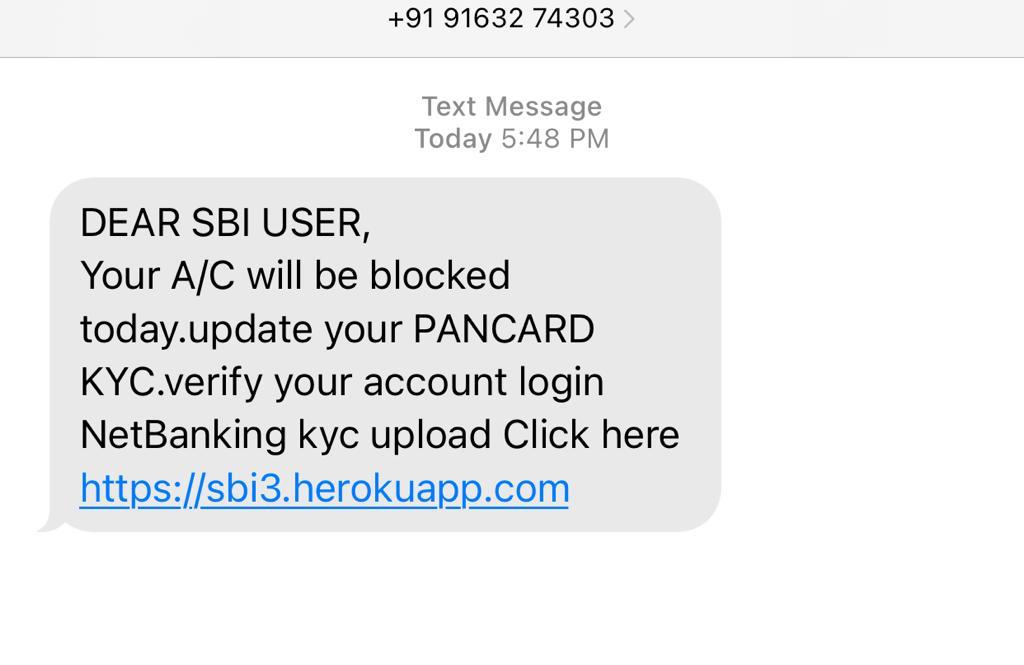

Cyber Fraud: On 26 March 2022, immediately an SMS got here on my telephone. In which it was written that SBI consumer, immediately your checking account can be blocked. Update your PAN card and KYC. Click on this (URL) to add your account login WebBanking KYC http://sbi3.herokuapp.com. Delhi’s Mayank Singh (identify modified) advised this. After seeing this message, Mayank known as on the telephone quantity from which the message had come, the bell was going however nobody picked up the telephone. When Mayank learn the URL rigorously, he realized that there’s something black within the pulse. Because he had already completed KYC. Actually the fraudster was making an attempt to cheat Mayank on-line. The URL that was despatched to Mayank appeared faux simply by it.

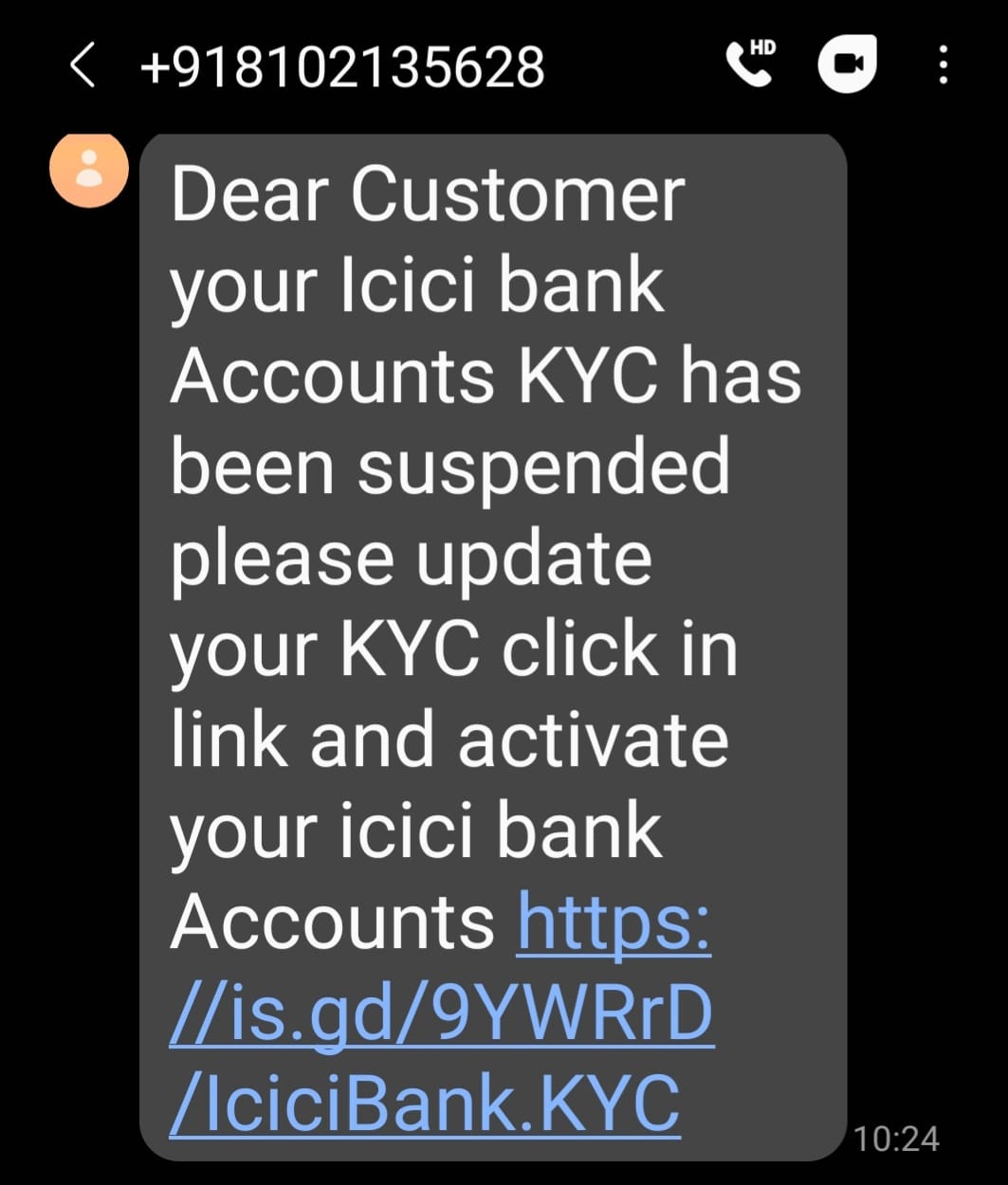

Similar SMS additionally got here to Arvind Kumar (identify modified). It was written within the SMS that Dear Customer, your ICICI Bank account KYC has been suspended. Click on this URL https://is.gd/BkDJ7H.ICICI.LOGIN and Update KYC and Activate ICICI Bank Account. It could be clearly seen on this message that this URL of ICICI Bank is faux.

financial institution fraud with faux sim card

Common folks within the nation are consistently falling prey to cyber fraud by the sort of message. Cyber specialists say that some of these cyber frauds are completed in a really organized manner. Cyber fraudsters change the SIM card instantly after committing the fraud. This week, Vodafone Idea, a telecom service supplier on the directions of the Madhya Pradesh Cyber Police, blocked 8,000 SIM playing cards which had been issued on the idea of improper id playing cards. The SIM card was issued to those cyber thugs within the identify of another individual.

Last 12 months, 16000 pre-activated SIM playing cards had been seized in Odisha, regardless that folks weren’t conscious that SIM playing cards had been issued of their names. Getting a SIM card and opening a checking account in different nations is a problem. In the identify of getting subsidy within the villages, folks give their Aadhaar to the gang of cyber thugs. The SIM card is issued within the identify of those folks by fingerprint and the account is opened and they don’t even know. To commit cyber fraud, a thug wants a SIM card and a checking account quantity. Both of those don’t occur with out KYC. In the investigation, it’s discovered that each the SIM playing cards are in another person’s identify.

Fraud elevated as a result of faux telephone name

According to the Global Tech Support Scam 2021 report, 51 p.c of frauds in India have occurred by pop-up advertisements or home windows. 42 p.c of Indians fell into the entice of hackers by unsolicited emails, 48 p.c by redirect web sites. 31 p.c individuals are falling prey to fraud by undesirable calls. Comparison with final 12 months’s knowledge reveals that the largest enhance has been in frauds by undesirable calls.

Most cash is misplaced in cash switch

According to a Microsoft survey, 43 p.c of individuals have misplaced their cash throughout financial institution transfers. At the identical time, 38 p.c folks have been victims of fraud on the time of cost by reward playing cards, 32 cost apps, 32 p.c by bank cards. According to cyber specialists, to stop cybercrime, the federal government ought to make strict on banks that no checking account can be opened with out private verification, which can cease opening faux accounts. At the identical time, if a single SIM card is issued with out correct KYC, then penalty needs to be imposed on the telecom corporations.

The authorities advised Parliament that the Indian authorities is making efforts to give attention to making certain the safety of digital funds and creating consciousness amongst residents about safe digital cost practices. Transactions are secured with two-tier authentication for the protection of on-line banking and ATM clients. Online-banking frauds primarily come up as a result of unintentional compromise of credentials by the shopper. Various measures have been taken by the federal government to manage such incidents.

MeitY has requested all banks and cost service suppliers to conduct campaigns to advertise safe cost practices to unfold consciousness. RBI has mandated that each one new playing cards issued by banks – debit and credit score, home and worldwide ATM playing cards – be EMV chip and PIN based mostly playing cards to keep away from cloning.

learn this additionally

[ad_2]